This analysis report, backed by quality data, covers the major developments the Web3, Blockchain, and Crypto sectors have experienced this week.

1. Nyheter den här veckan

- Apple’s Mac Security Vulnerability Exposed

A critical flaw in Apple’s M-series chips poses a risk to users’ cryptographic private keys. Researchers suggest a workaround, but it may significantly impact device performance, highlighting the urgent need for a direct resolution to safeguard user data.

- Hackers Launder Funds Through Tornado Cash

Despite sanctions, hackers continue to move stolen assets, totaling $145.7 million, through Tornado Cash. The platform’s role in obscuring fund ownership raises concerns, emphasising the ongoing challenges in tracking illicit cryptocurrency transactions.

- Google Adds ENS Support for Ethereum Wallets

Google extends support to display Ethereum wallet balances using Ethereum Name Service (ENS) domains. This integration streamlines cryptocurrency transactions by replacing complex wallet addresses with human-readable domains, enhancing accessibility and usability for users engaging with Ethereum-based assets.

- Blockchain Game Exploited Before Launch

Exploitation of a smart contract bug led to a $4.6 million loss for Super Sushi Samurai just before its anticipated launch. This incident underscore the importance of rigorous smart contract auditing and testing to mitigate vulnerabilities and safeguard user funds in blockchain-based applications.

- OKX To Halt Services in India

OKX announces the cessation of services in India, citing regulatory concerns. This move follows a broader trend of regulatory crackdown on cryptocurrency exchanges by governments around the world.

- Tornado Cash Developer Accused of Money Laundering

Alexey Pertsev faces accusations of laundering $1.2 billion through Tornado Cash, despite denying involvement in breaching money laundering laws. The indictment from the Netherlands alleges over 30 illegal transactions on the platform.

- Binance Founder Launches Education Project

Former Binance CEO, Changpeng Zhao, initiates a non-revenue, free education project targeting underprivileged children in developing countries. This philanthropic effort aims to bridge educational gaps and empower marginalised communities through access to knowledge and opportunities in emerging technologies.

2. Blockchain-prestanda

I det här avsnittet kommer vi att analysera två faktorer i första hand: de högst presterande blockkedjorna baserat enbart på deras 7-dagars förändring och de topppresterande bland de fem bästa blockkedjorna med högst TVL.

2.1. Bästa Blockchain-utövare av 7-Day Change

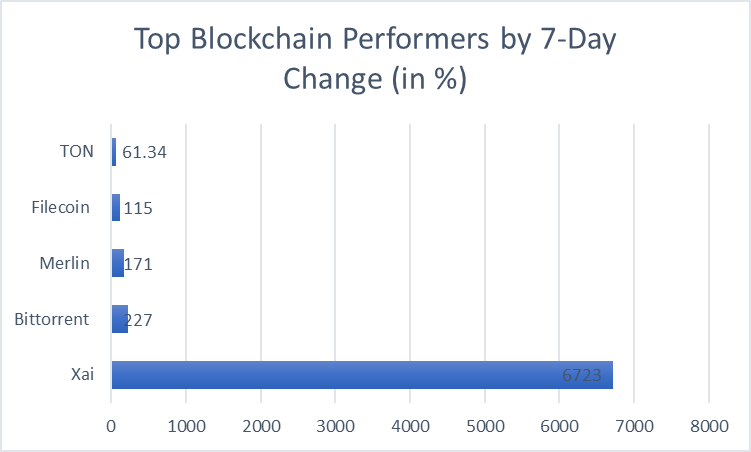

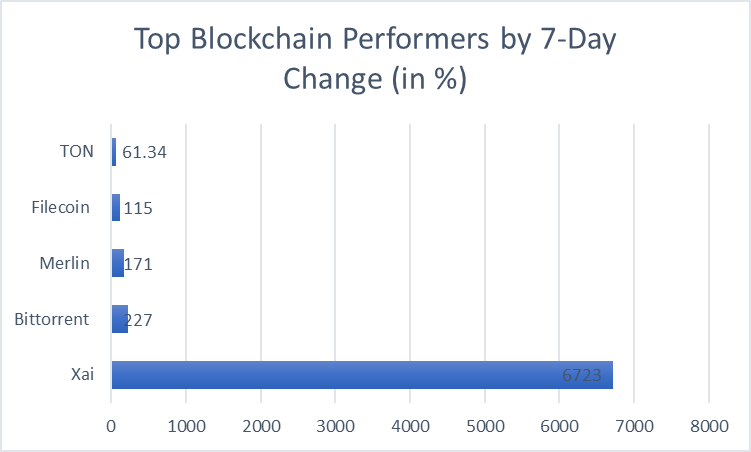

This week’s top blockchain performers, based on their 7-day change, are Xai, Bittorrent, Merlin, Filecoin, and TON.

| Blockchain | 7-dagars förändring (i %) | TVL |

| Xai | 6723% | $931,142 |

| Bittorrent | + 227% | $ 1.1M |

| Merlin | + 171% | $ 38.49M |

| Filecoin | + 115% | $ 39.21M |

| TON | + 61.34% | $ 72.05M |

Among the top blockchain performers by 7-day change, Xai leads with an impressive 6723% increase, indicating significant market activity. Bittorrent follows with a substantial 227% growth, while Merlin, Filecoin, and TON also demonstrate notable uptrends.

2.2. Topppresterande: 7-dagars förändring i topp 5 blockkedjor med högsta TVL

Ethereum, TRON, BNB Smart Chain, Solana och Arbitrum One är de fem bästa blockkedjorna på marknaden baserat på TVL och marknadsdominans. Låt oss se hur de fem bästa blockkedjorna har presterat den här veckan, med hjälp av 7-dagars TVL-byte.

| Blockchain | 7d förändring (i %) | Dominans (i %) | TVL (i miljarder) |

| Ethereum | -8.23% | 61.19% | $ 48.497B |

| TRON | -5.37% | 11.18% | 9.505B |

| BNB Smart kedja | -4.17% | 7.07% | 5.594B |

| Solana | -5.03% | 4.83% | $ 3.954B |

| Arbitrum ett | -5.88% | 4.63% | $ 3.159B |

| Övrigt | 11.10% |

Among the top 5 blockchains with the highest Total Value Locked, Ethereum exhibits the largest decline with -8.23% over 7 days. Following suit, Arbitrum One, TRON, Solana, and BNB Smart Chain also experienced negative changes, indicating potential market corrections.

3. Kryptomarknadsanalys

Analysen av kryptopris och dominans och analys av toppvinster och förlorare är de två främsta faktorerna för analysen av kryptomarknaden.

3.1. Krypto 7-D Prisförändring och dominansanalys

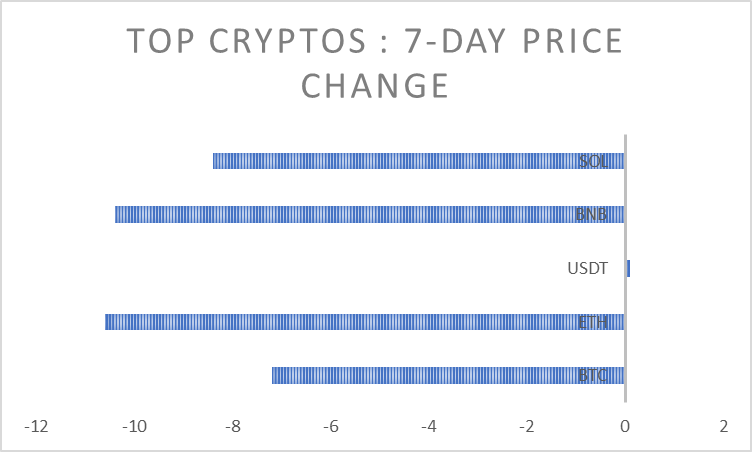

Bitcoin, Ethereum, Tether, BNB och Solana är de bästa kryptovalutorna enligt börsvärde och dominansindex. Låt oss analysera deras sju dagars prisförändring.

| kryptovaluta | Dominansprocent | 7d- Ändring (i %) | Pris | Börsvärde |

| BTC | 49.04% | -7.2% | $64,084.16 | $1,258,101,656,738 |

| ETH | 15.65% | -10.6% | $3,331.20 | $400,013,898,271 |

| USDT | 4.09% | + 0.1% | $1.00 | $104,192,005,600 |

| BNB | 3.32% | -10.4% | $550.28 | $84,836,562,746 |

| SOL | 3.02% | -8.4% | $172.49 | $76,505,792,215 |

| Övrigt | 24.88% |

In the realm of top cryptocurrencies, ETH and BNB experienced significant declines of -10.6% and -10.4% respectively over 7 days. SOL and BTC also saw notable drops of -8.4% and -7.2% correspondingly. However, USDT showed minimal fluctuation with only a +0.1% change.

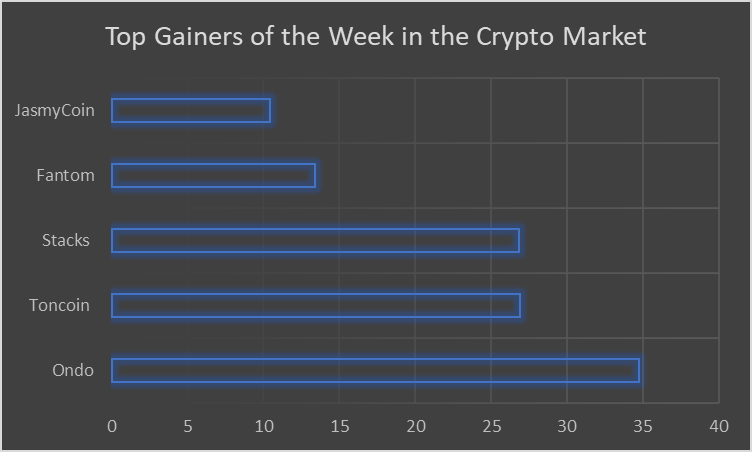

3.2. Veckans bästa vinnare och förlorare på kryptomarknaden

Här är listan över veckans bästa vinnare och bästa förlorare på kryptovalutamarknaden. Analysen görs med hjälp av 7-dagars Gain och 7-day Lose-index.

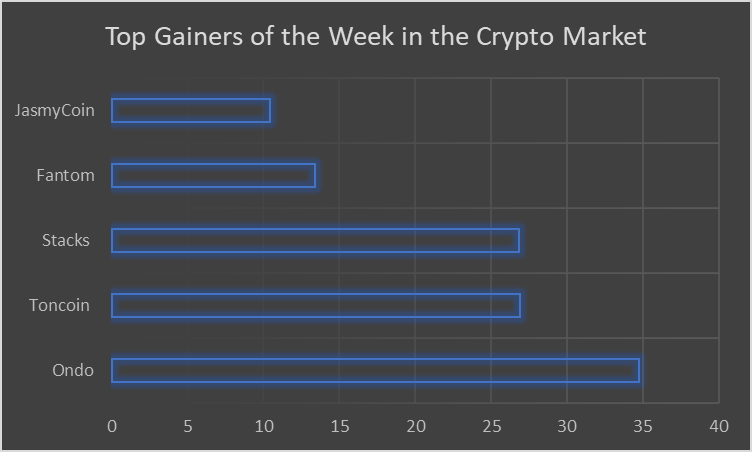

3.2.1. Veckans bästa vinnare i Crypto

| kryptovaluta | 7-dagarsvinst | Pris |

| ondo | + 34.75% | $0.7029 |

| toncoin | + 26.89% | $4.79 |

| Stacks | + 26.83% | $3.53 |

| Fantom | + 13.38% | $1.09 |

| jasmycoin | + 10.44% | $0.02071 |

In the crypto market, Ondo emerged as the top gainer of the week with a significant 34.75% increase, followed closely by Toncoin and Stacks at +26.89% and +26.83 respectively. Fantom and JasmyCoin also saw notable gains at +13.38% and +10.44%.

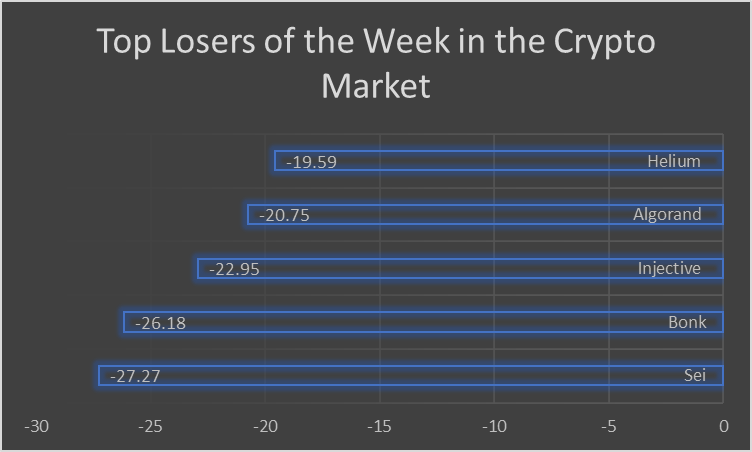

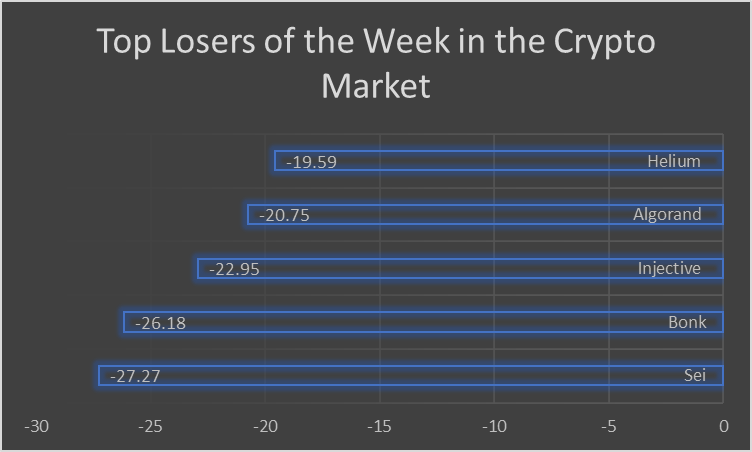

3.2.2. Veckans bästa förlorare i Crypto

| kryptovaluta | 7-dagars förlust | Pris |

| Sei | -27.27% | $0.8024 |

| Bonk | -26.18% | $0.00002225 |

| Injektiv | -22.95% | $35.36 |

| Algorand | -20.75% | $0.241 |

| helium | -19.59% | $6.55 |

In the crypto market, Sei experienced the most significant loss of the week at -27.27%, followed closely by Bonk at -26.18%. Injective, Algorand, and Helium also saw notable declines at -22.95%, -20.75%, and -19.59%.

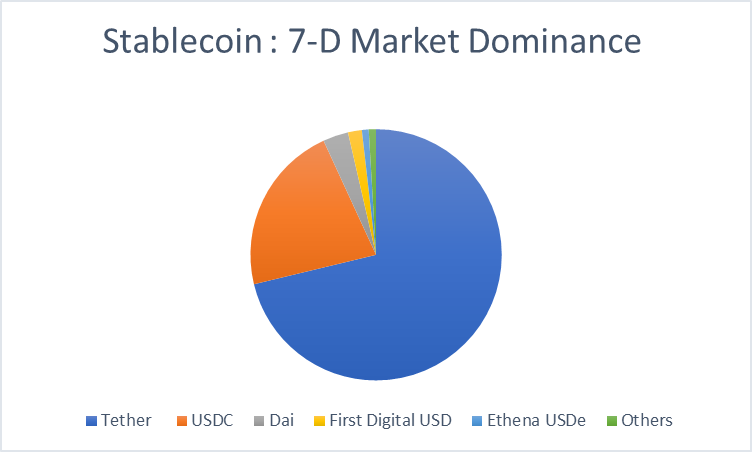

3.3. Stablecoin veckoanalys

Tether, USDC, DAI, First Digital USD och Ethena USDe är de bästa stabila mynten på marknaden när det gäller börsvärde. Låt oss analysera deras veckovisa resultat med sju dagars börsvärde, marknadsdominans och handelsvolymindex.

| Stablecoins | Marknadsdominans (7d) [i %] | Börsvärde (7d) | Handelsvolym (7d) | Marknadskapitalisering |

| Tether | 71.23% | $104,042,955,963 | $72,933,877,566 | $104,101,083,533 |

| USDC | 21.90% | $31,996,066,950 | $9,566,842,109 | $32,098,623,910 |

| Genom | 3.26% | $4,763,561,388 | $739,396,685 | $4,805,964,452 |

| Första digitala USD | 1.79% | $2,619,642,987 | $8,929,619,191 | $2,625,007,732 |

| Ethena USDe | 0.87% | $1,270,115,281 | $116,077,978 | $1,274,113,067 |

| Övrigt | 0.94% |

Among stablecoins, Tether dominates the market with a significant 71.23% market share over 7 days, indicating its widespread adoption and trust among users. USDC follows with a 21.90% share, while Dai, First Digital USD, and Ethena USDe hold smaller portions of 3.26%, 1.79%, and 0.87% respectively. This dominance reflects Tether’s role as a leading stablecoin for traders.

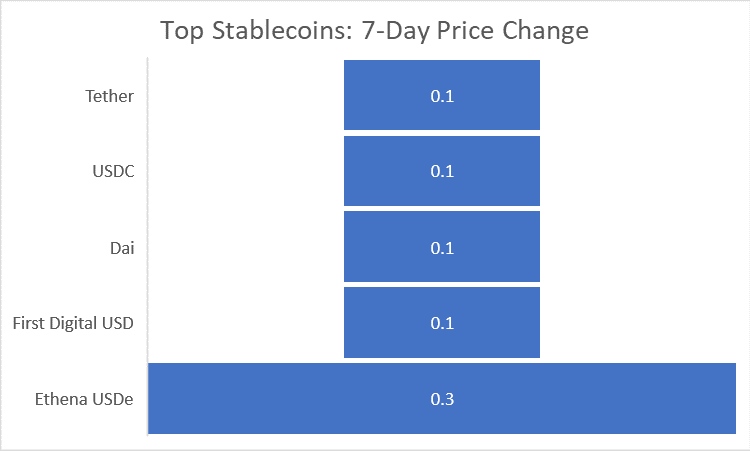

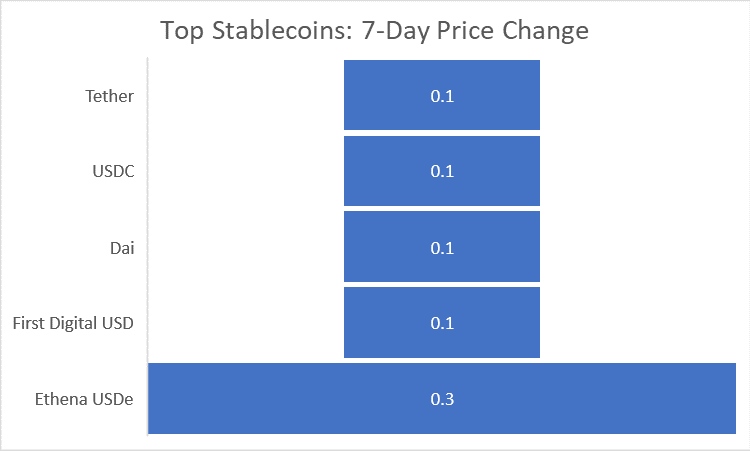

Låt oss analysera den veckovisa utvecklingen för de bästa stabila mynten ytterligare med hjälp av sju dagars prisförändringsindex.

| Stablecoins | 7-dagars prisändring (I%) | Pris |

| Tether | + 0.1% | $0.9995 |

| USDC | + 0.1% | $0.9995 |

| Genom | + 0.1% | $0.9986 |

| Första digitala USD | + 0.1% | $1.00 |

| Ethena USDe | + 0.3% | $0.9982 |

Among top stablecoins, Ethena USDe experienced the highest 7-day price change with a modest increase of +0.3%, followed by Tether, USDC, Dai, and First Digital USD, all showing a +0.1% change. These minimal fluctuations indicate stability in the prices of these stablecoins.

4. Bitcoin ETF veckoanalys

Bitcoin Futures ETF:er och Bitcoin Spot ETF:er bör analyseras separat, för att få rätt bild av Bitcoin ETF-marknaden, eftersom de representerar två olika segment. Låt oss börja!

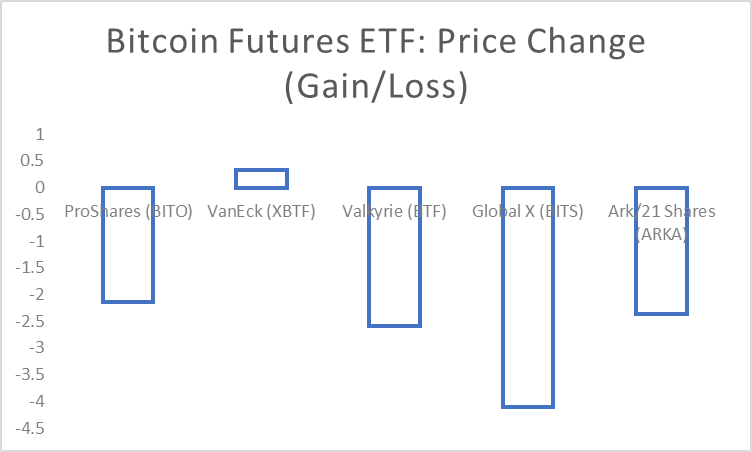

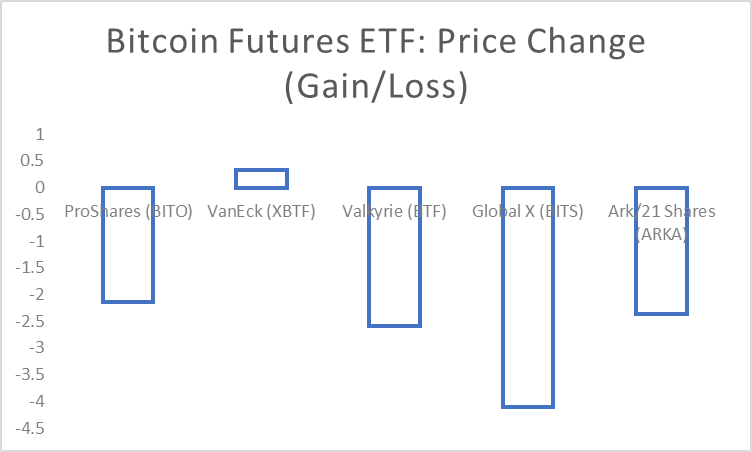

4.1. Bitcoin Futures ETF veckoanalys

ProShares (BITO), VanEck (XBTF), Valkyrie (BTF), Global X (BITS) och Ark/21 Shares (ARKA) är de bästa Bitcoin Future ETF:erna enligt Asset Under Management-indexet. Låt oss använda indexet för prisförändringsprocent för att analysera dessa ETF:er.

| Bitcoin Futures ETF:er | Prisförändring (vinst/förlust) [i %] | Tillgång under förvaltning (i miljarder) | Pris |

| ProShares (BITO) | -2.15% | $ 598.78M | $29.16 |

| VanEck (XBTF) | + 0.33% | $ 42.41M | $39.22 |

| Valkyrie (BTF) | -2.60% | $ 38.20M | $19.45 |

| Global X (BITS) | -4.10% | $ 26.10M | $67.12 |

| Ark/21 aktier (ARKA) | -2.37% | $ 8.01M | $62.17 |

Among Bitcoin Futures ETFs, VanEck’s XBTF showed the highest gain with +0.33% over the period, indicating slight positive momentum. In contrast, Global X’s BITS experienced the largest loss at -4.10%, followed by Valkyrie’s BTF, Ark/21 Shares’s ARKA, and ProShares’s BITO, all posting negative change.

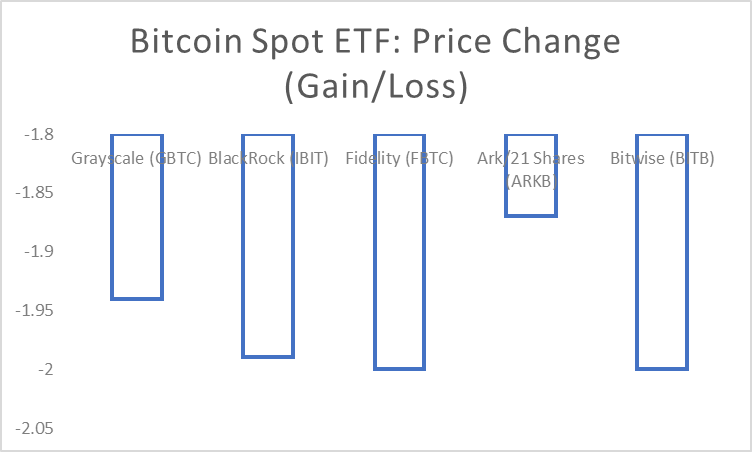

4.2. Bitcoin Spot ETF veckoanalys

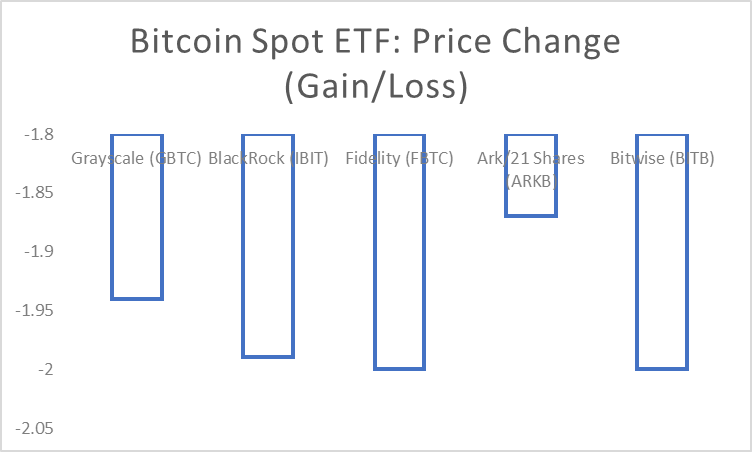

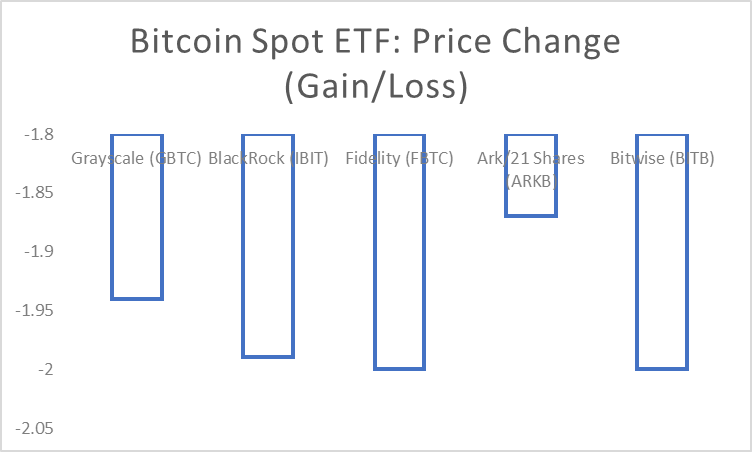

Gråskala (GBTC), Blackrock (IBIT), Fidelity (FBTC), Ark/21 Shares (ARKB) och Bitwise (BITB) är de bästa Bitcoin Spot-ETF:erna enligt Asset Under Management-indexet. Låt oss analysera dem med hjälp av prisförändringsindex.

| Bitcoin Spot ETF:er | Prisförändring (vinst/förlust) [i %] | Tillgång under förvaltning (i miljarder) | Pris |

| Gråskala (GBTC) | -1.94% | $ 27.68B | $56.98 |

| BlackRock (IBIT) | -1.99% | $ 15.85B | $36.41 |

| Fidelity (FBTC) | -2.00% | $ 8.85B | $55.91 |

| Ark/21 aktier (ARKB) | -1.87% | $ 2.62B | $64.00 |

| Bitvis (BITB) | -2.00% | $ 1.96B | $34.84 |

In the Bitcoin Spot ETF category, Fidelity’s FBTC and Bitwise’s BITB both experienced a -2.00% decrease in price. BlackRock’s IBIT showed a slightly lower loss at -1.99%. Grayscale’s GBTC and Ark/21 Shares’s ARKB also show declines at -1.94% and -1.87% respectively.

5. DeFi Market Weekly Status Analysis

Lido, EigenLayer, AAVE, Maker, JustLend är de fem bästa DeFi-protokollen på basis av TVL. Låt oss analysera dess veckoprestanda med hjälp av 7d Change index.

| DeFi-protokoll | 7d ändring (i totalt värde låst) [i %] | TVL |

| Shore | -11.01% | $ 32.701B |

| Eget lager | -5.80% | $ 10.892B |

| AAVE | -7.29% | $ 10.494B |

| Maker | -9.19% | $ 8.392B |

| Bara land | -6.33% | $ 7.189B |

Over the past 7 days, DeFi protocols experienced declines in Total Value Locked. Lido and Maker saw the largest decrease at -11.01% and -9.19%, respectively, suggesting potential withdrawals or decreased activity. AAVE, JustLend, and EigenLayer also showed declines in TVL, indicating a possible shift in user funds within the DeFi ecosystem.

6. NFT Marketplace: En grundläggande veckoanalys

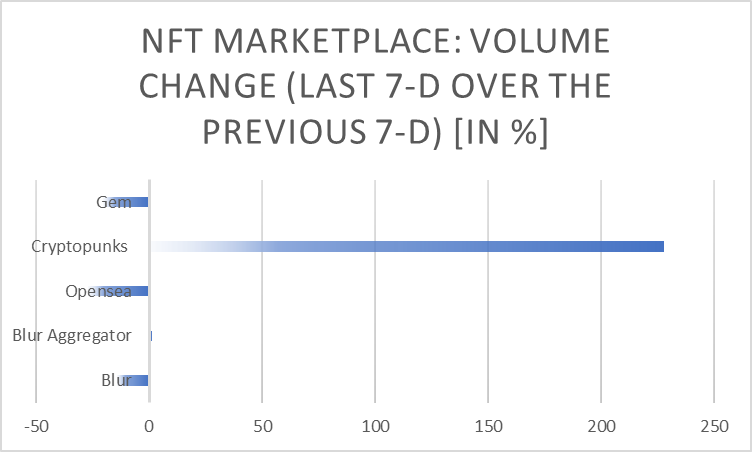

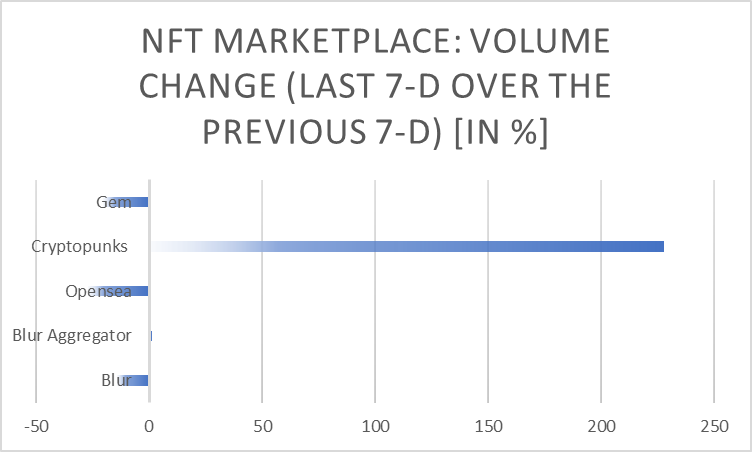

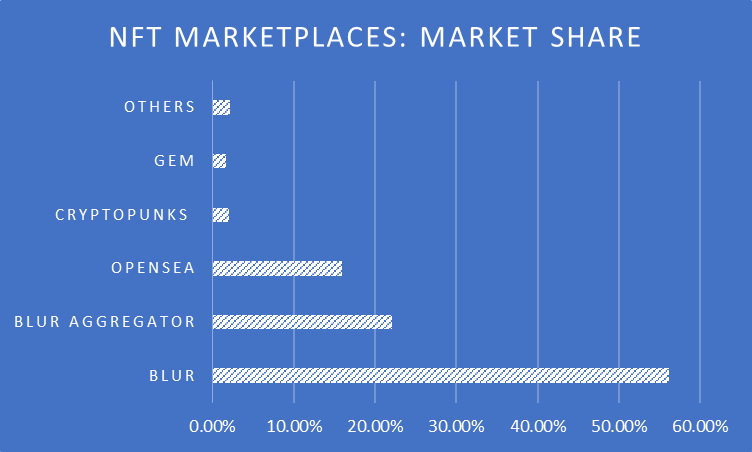

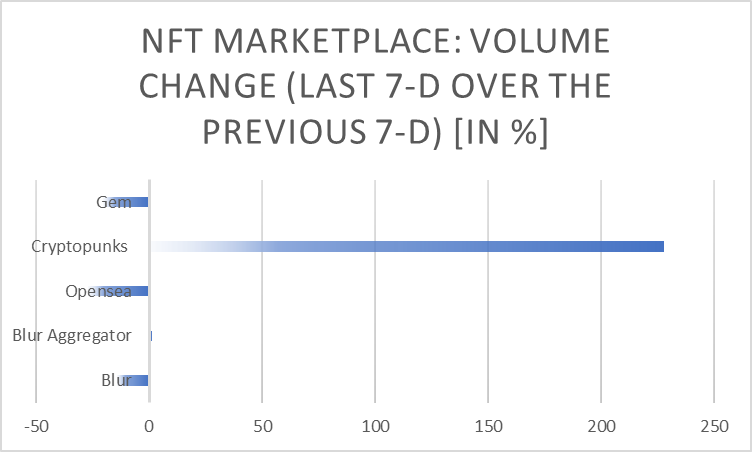

Blur, Blur Aggregator, Opensea, Cryptopunks, and Gem are the top NFT marketplaces on the basis of market share. Let’s analyse them using the Volume Change (change of last 7d volume over the previous 7d volume) index.

| NFT-marknadsplatser | Marknadsandel | Volymändring [Senaste 7 dagarna jämfört med föregående 7 dagars volym] | 7-dagars rullande volym | 7-dagars rullande handel |

| Fläck | 56.19% | -14.31% | 21198.54 | 33197 |

| Blur Aggregator | 22.09% | + 1.20% | 11750.04 | 14868 |

| Öppet hav | 15.97% | -27.13% | 6115.22 | 22155 |

| Kryptopunkar | 1.98% | + 228% | 6128.92 | 25 |

| Save | 1.62% | -20.29% | 1217.31 | 3793 |

| Övrigt | 2.149% |

In the NFT marketplace sector, Cryptopunks exhibited a significant surge in volume, with a remarkable +228% change over the previous 7 days, indicating heightened activity and interest. Conversely, Opensea, Gem and Blur experienced decrease in volume at -27.13%, -20.29%, and -14.31% respectively, suggesting a potential slowdown in trading activity.

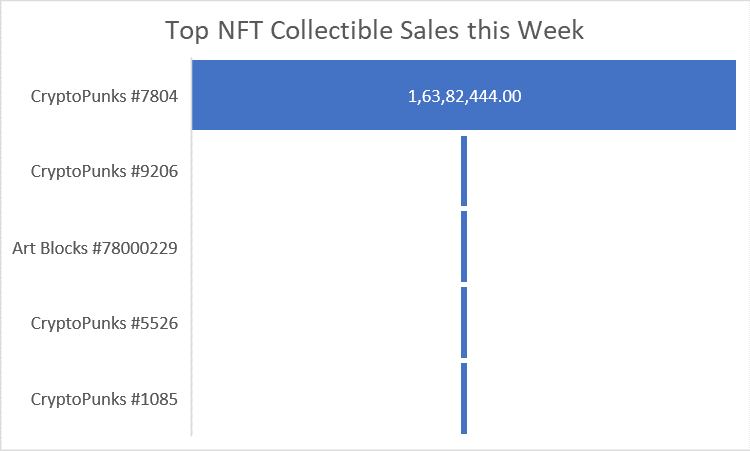

6.1. Bästa NFT-samlarförsäljningen denna vecka

CryptoPunks #7804, CryptoPunks #9206, Art Blocks #78000229, CryptoPunks #5526, and CryptoPunks #1085 are the top NFT collectable sales reported this week in the NFT market landscape.

| NFT samlarobjekt | Pris (i USD) |

| CryptoPunks #7804 | $16,382,444.00 |

| CryptoPunks #9206 | $226,990.00 |

| Konstblock #78000229 | $220,357.62 |

| CryptoPunks #5526 | $216,732.47 |

| CryptoPunks #1085 | $215,497.58 |

This week’s top NFT collectible sales feature crypto CryptoPunks #7804 as the highest-priced item at $16,382,444.00, indicating strong demand and scarcity. Following, CryptoPunks #9206, Ark Blocks #78000229, and CryptoPunks #5526 and #1085 show significant prices. These sales highlight the continuing popularity of CryptoPunks collectibles.

7. Web3 Veckofinansieringsanalys

7.1. ICO Landscape: A Weekly Overview

Oxya Origin, Bowled, Dappad, and Castle of Blackwater are the major ICOs that ended this week. Let’s analyse how much they have received.

| ICO | Mottagna | Token Price | Insamlingsmål | Totala tokens | Token (tillgänglig för försäljning) |

| Oxya Ursprung | $2,310,000 | $0.02 | $330,000 | 1,000,000,000 | N / A |

| bowled | $3,430,000 | $0.07 | $400,000 | 500,000,000 | 19% |

| Dappad | $1,720,000 | $0.02 | $500,000 | 1,000,000,000 | 17% |

| Castle of Blackwater | N/Al | $0.1 | $200,000 | N / A | N / A |

Among the major ICOs ending this week, Bowled raised $3,430,000, Oxya Origin received $2,310,000, and Dappad collected $1,720,000. These amounts signify investor interest and potential funding for blockchain projects, indicating the market’s appetite for new digital assets and decentralised applications.

8. Veckovis Blockchain Hack Analysis

As of March 23, 2024, hackers stole a massive $7.69 billion. Most of this, about $5.84 billion, was taken from decentralised finance platforms. Another $2.83 billion was stolen from bridges connecting different blockchain networks.

On March 8, 2024, Unizon lost around $2.1 million to hackers. On March 5, WOOFI was targeted, losing $8.5 million. Seneca lost $6.5 million on February 28, while Tectonica lost $0.25 million on February 22.

However, the biggest hit this year was taken by FixedFlot, which lost $26.1 million to a hacking attack.

Endnote

In this week’s comprehensive analysis of Web3, Blockchain and Crypto, we have brought out powerful insights that can be used to stay relevant to market developments. As the landscape evolves, the strategic integration of technology and data-driven decision-making becomes paramount for stakeholders navigating the dynamic realms of decentralised technologies.

Source: https://coinpedia.org/research-report/weekly-crypto-roundup-current-news-blockchain-trends-bitcoin-and-stablecoin-analysis-and-more-insights/